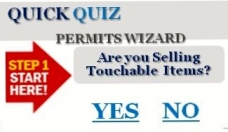

Get a California Seller's Permit

Click

to Find Out if You Need the Permit(s).

Click

to Find Out if You Need the Permit(s).

It's easy to apply, download a seller’s permit application and mail it to us along with copies of any requested documents. You can also drop by the nearest office and apply in person.

Permits are generally available the same or following day if you apply in person. If you apply by mail, you will usually get your permit within 7 to 14 days.

Here is the info you need to have handy.

- Names and addresses of suppliers

- Name and address of bookkeeper or accountant

- Two personal references

- Expected average monthly sales and the amount of those sales which are taxable

- If you have purchased an existing business, you must also provide the previous permit information

Partners, corporate officers, limited liability company managers/members/officers, must also provide information.