Florida Seller Permit

Seller's PermitWill You Buy Merchandise Wholesale or Sell Wholesale, or Sell Retail In Florida?

Because of Florida Sales Tax, You Need a Florida Seller's Permit

Florida's sales tax rate is 6 percent.

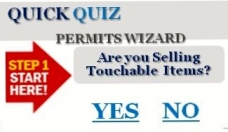

Click

to Find Out if You Need the Permit(s).

Click

to Find Out if You Need the Permit(s).

Each store you have and each retail sale, charge, storage, use, or rental is taxable, along with some taxable services. Some items are specifically exempt. A few counties impose an additional sales surtax in addition to the 6 percent state tax. The county tax rates can range from .25% to 2.5% percent, and are charged to the merchant on the first $5,000 of the purchase price. The $5,000 limit does not apply to commercial rentals, transient rentals, or services. Buyers of retail merchandise pay sales tax and any county-imposed taxes to the seller at the time of purchase.

Use Tax

If you are a consumer and you buy out of state, by mail, over the internet or have it delivered in Florida by a common carrier and it is taxable merchandise, you need to pay FL sales tax. Unless specifically exempt, merchandise you purchased out of state is subject to tax when brought into Florida within 6 months of the purchase date. This "use tax," as it is commonly called, is also assessed at the rate of 6 percent. Examples of such taxable purchases include purchases made by mail order or the Internet, furniture delivered from dealers located in another state, and computer equipment delivered by common carrier. Items purchased and used in another state for 6 months or longer are not subject to use tax when the items are later brought into Florida.

Sales & Use Tax, Sellers Permit

Getting a Seller's Permit

Generally

What is a seller's permit?

Who must get a seller's permit?

Seller's permit application?

What is a sales tax?