Frequently Asked Questions

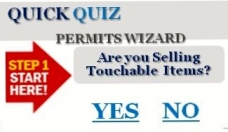

Q: Who must obtain a seller's permit?

A: If you are in business in any particular state,

you need to get a seller's permit for that state. So long as

you have a location, representatives, agents or canvassers in any

particular state, and you sell tangible products you need a seller's

permit for that state. Tangible products are products that

ANYONE can touch, such as furniture or any other concrete substance.

The requirement applies to any business whatever the form. So, for

example, if you are a sole proprietor, a partnership or a

corporation / LLC, you need to get a seller's permit.

Note that if all the conditions above apply and you also just do

temporary sales in that state you still need a temporary license for

that state.

Click

to Find Out if You Need the Permit(s).

Click

to Find Out if You Need the Permit(s).

Q: What Does it Qualify as Doing Business or Engaged in a Business Activity in This State?

A: Generally , if you have a sales office or room, warehouse, or

other place of business in the state including temporary offices or

agents in this state. Your sales representative, agent, or

canvasser operating and selling in this state whether selling,

renting, leasing or any other activity that concerns the sale of

tangible items, the lease or trade of taxable items requires a

seller's permit.

Q: What items are tangible and subject to

sales tax?

A: In general, retail or wholesale sales of touchable personal

property are subject to sales tax. Touchable property is property

such as furniture, giftware, toys, antiques, clothing, and so forth.

In addition, even if you manufacture tangible items even for you own

specific clientele, so long as it is tangible, it is taxable. Thus,

for instance, Atahualpa hires you to create some jewelry, and he

gives you the materials or you provide your own, the total price of

your item including the labor is taxable.

On the other hand, certain costs for repairs may not be taxable. For example, Atahualpa comes back to repair his jewelry and you do. You don't have to charge any taxes because no touchable products are created.

In the same line of thought, if Atahualpa buys a tent and he

wants you to install it in his palace in Peru, you don't have to

charge taxes because you installed something. You did not create or

sold a tangible item.